Mobile payments using NFC Technology Challenges in emerging markets

Key Features:

Request For a Brochure

Request For a Demo

Silbert on October 29, 2015, A recent Accenture survey states that though 52% of North Americans are “extremely aware” of mobile payments, only 18% use them regularly. As expected, Millennial and higher-income households are relatively fonder of contactless payments. The percentage users for these categories are 23 and 38 respectively. It has been studied that they do contactless payments at least once a week.

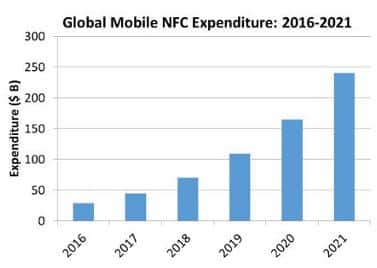

The data shows a big challenge for the mobile payments but emarketer has forecasted a 210% growth in the total value of mobile payment transactions in the current year. In developed countries, the percentage does not seem surreal. Fast Internet network, required infrastructure, good purchasing power of consumers for purchasing NFC enabled mobiles, all the resources are present for making hard cash during transaction a history. Also, many business owners such as Starbucks have shown clear value propositions to the consumers for enhancing mobile payments by offering incentives for it. Moreover the business men also get such clear incentives in terms of ease, money and more customers due to faster service which convince them for investing in updating infrastructure for implementing the change.

But in many developing countries, there is slow internet connection speed, minimal network reach, and weak infrastructure. Also, there is slow penetration of new generation smart phones which can be attributed to high poverty. The majority of the population still have old generation phones, which do not support apps. To rectify this problem, either the gap between old and new technologies should be filled up by mobile payment providers or the consumer will have to upgrade their mobile so as to use NFC enabled mobile payments which is not feasible for most of the consumers with lower purchasing power.

72.2% of Indian population lives in villages where traditional method of payment is given priority over anything. They are quite scared of new technologies and related frauds attributing to their no or less education. The idea of paying through a mobile device can make them uneasy, especially because they are so accustomed of keeping their hard earned money close to themselves. The right amount of education regarding NFC technology would be crucial in these areas.

There is one more challenge of security. Though companies like Apple, Samsung, and Google has introduced some clever safeguards to protect users, others might have been little behind in this aspect. This may give hackers to steal our personal information, including our address and account details through NFC skimming apps.

So, though NFC technology is faster, convenient and secured than other contemporary technologies, it still has not become ubiquitous attributing to the above stated challenges. Unless it acknowledges the population at the bottom of the pyramid, it would find difficult to penetrate the global market completely.